Investment Case Details

Conventional Energy & Power (Package 1 – Great Inland Pumped Hydro Energy Storage Project)

A$41,093.00

A$250,000.00

Package Summary (Upper Reservoir & Dam Construction)

Scope of Works

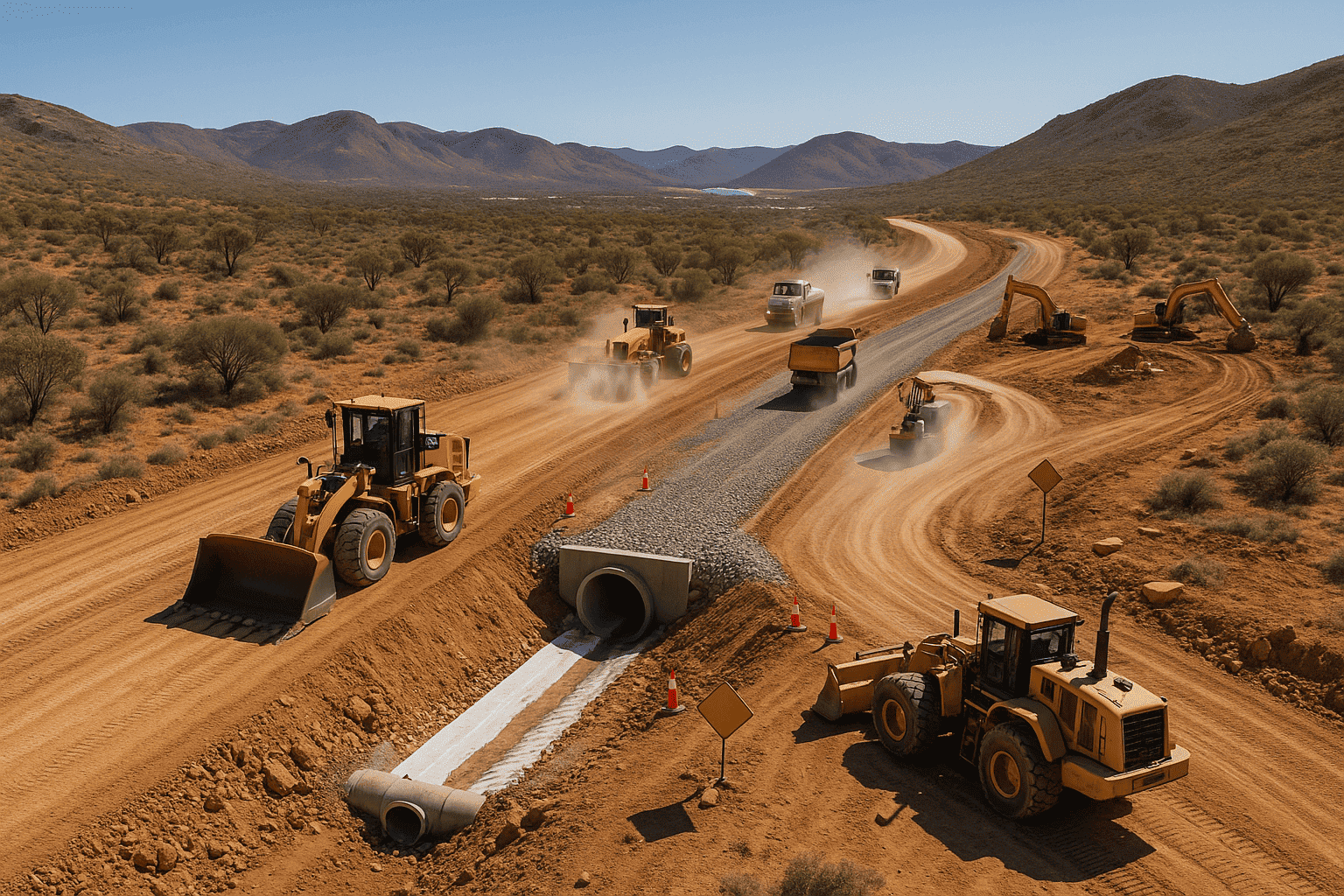

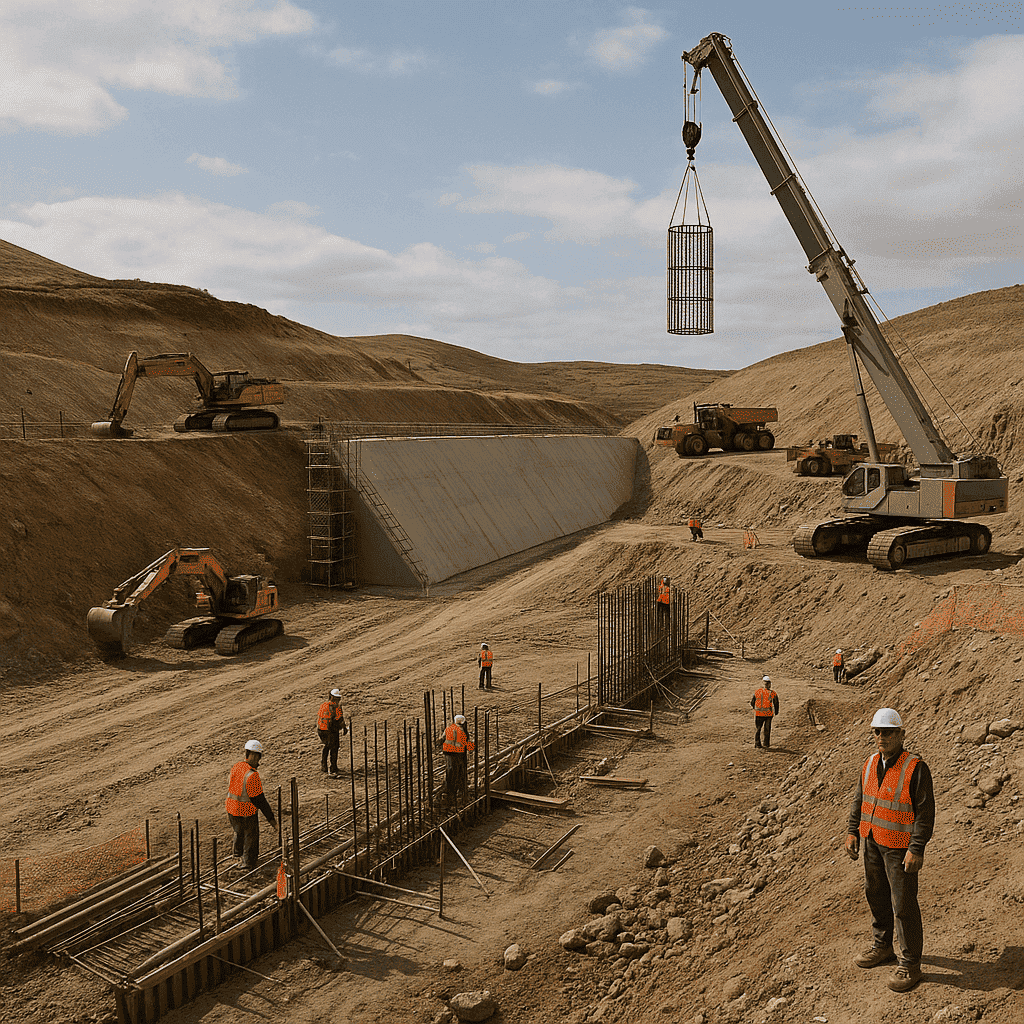

- Earthworks & Site Preparation – Excavation, grading, and foundation works for the dam wall.

- Dam Wall Construction – Roller-compacted concrete (RCC) and reinforced spillway systems.

- Reservoir Lining – High-durability liners to minimise seepage and evaporation.

- Inlet/Outlet Structures – Engineering intake towers and penstocks to control water flow to turbines.

- Environmental Safeguards – Fish bypass systems and water quality management infrastructure.

- Access & Logistics Roads – Construction of service routes for heavy equipment.

- Early-Stage SCADA Integration – Sensors to monitor water levels and structural health.

Investment Terms

Case ID: C4G4CRCV6S4S

Use of Funds

Schedule & Milestones

Fees

Key Risks

How the Process Works

Strategic Rationale

- Foundation for Entire System – The upper reservoir is essential for energy storage operation.

- Long Asset Life – Dam structures can last over 50 years with proper maintenance.

- High Storage Capacity – Enables the sale of stored energy during premium pricing periods.

- Critical Grid Role – Provides reliable backup during outages or renewable shortfalls.

Comments

Review

After allocation on cleared funds. Accruals are daily, tracked in your dashboard.

No. Loyalty uplift is non-compounding and applied to the base target return if you complete a band without withdrawing.

Minimum A$400. Maximum A$20,000 for this package.

Accruals are calculated daily and paid per the case terms. Check your dashboard for the payout cadence and history.

Application monies are held in an Application Monies Trust/Suspense Account until allocation.

Offer documents by email (PDS + TMD for retail, or IM for wholesale), plus ongoing updates in your account.

Standard identity and residency checks (government ID, address, and any required AML/CTF verifications).

A buffer of up to +60 days can be applied with notice. Targets remain targets; they are not guaranteed.

Yes—pumped hydro is established grid technology used globally for long-duration energy storage.

The system is closed-loop; the same water cycles between reservoirs with minimal top-up requirements.

Pumped hydro is built for energy storage (charge with surplus power, discharge at peak). It’s not just run-of-river generation.

Earthworks and civil structures for the upper reservoir and dam wall, lining, intake/outlet structures, access roads, and early SCADA monitoring.

Yes. Milestones and case updates are posted in your dashboard; you’ll also receive email updates at key stages.

Eligibility is assessed during application and KYC. Retail applicants receive PDS/TMD; wholesale/eligible investors receive an IM.

Retail only: 14 days cooling-off (s1019B). Wholesale offers generally do not include cooling-off.

We don’t provide tax advice. Seek independent advice for your situation. Transaction records are available in your account.

Subject to availability and prevailing terms at that time. You can request re-allocation or withdrawal in your dashboard.

Construction and schedule, geotechnical/hydrology, regulatory/environmental approvals, cost escalation, counterparties, and grid/operational dependencies.

We understand you may want to visit—but we run a closed worksite during active construction. No tours, no pins, no drive‑bys. We build while others give tours. Why (business‑first, not a debate) Schedule integrity: A “quick look” triggers crew pauses, escort duty, and safety briefs. That “hour” can wipe half a day of momentum and bump critical pours/lifts. Margin protection: VIP walks cost twice—direct burn and lost output. Do a few and you’ve funded delay instead of delivery. Safety & liability: More bodies = more chances for an incident. Zero upside, all downside. Fairness & scale: Let one in and you owe everyone the same. Ops becomes concierge duty. IP & rumor control: Phones out = layouts, sequencing, vendor intel in the wild—free ammo for competitors. Narrative control: Random mud shots read as “delay.” Documents keep focus on dates, dollars, delivery. Crew focus: Tours turn builders into museum guides. Output drops; defects rise. What you get instead (final) Documents: For retail investors we provide the PDS and TMD. For wholesale/professional investors we provide the IM. No additional packs or media. Where the rest lives: Current case details are on the website. We don’t email photos, videos, or location pins. Briefing: A focused 15–20 minute phone call with a dedicated team member for a progress briefing and Q&A on the numbers. No construction walkthroughs. Authority: If any wording on the site differs, the PDS/IM governs. House rule: We don’t issue extra paperwork to explain what we don’t provide. Location disclosure We do not publish a precise map pin or “view from the road” spots. The area isn’t configured for public viewing; please don’t stop or loiter near the perimeter. Bottom line Money talks; tours don’t. You get the docs and your %, and we keep the build moving.

Conventional Energy & Power (Package 1: Upper Reservoir & Dam Construction – Great Inland Pumped Hydro Energy Storage Project)

- Min A$400.00

- Max A$20,000.00

- Target daily ~ 0.60%

- Accrual days ~ 350

- Payouts On Request — Manager Approval

- Capital Back Yes — At Project Finish

- Start Allocation

Agreement Paper

Cases Info

- Created By REO Admin

- Created At 2025-05-01

- Raised AmountA$41,093.00

- Goal AmountA$250,000.00

Recent Cases

A$50,847.00

0.50%

A$57,612.00

0.60%

A$62,098.25

0.65%

A$83,148.00

0.95%